In the case of non-wilful failures to file, the penalty can be as high as $10,000 per account per year. There is a harsh penalty regime for the failure to file FBARs. All US persons who meet the financial interest or signature authority test with respect to a foreign financial account must file even if the account appears on another person’s FBAR. A US person has signature authority over a foreign financial account even if they require the signature of a co-signer or someone else can effectively block their signature. A US person has signature authority over an account if such person can control the disposition of assets by delivery of a document containing his or her signature to the bank or other person with whom the account is maintained. Financial accounts include any bank, securities, securities derivatives or other financial instruments accounts, including mutual funds and other commingled funds.Ī US person has a financial interest in a foreign financial account if the US person is the owner of record or has legal title OR if the US person owns more than 50 percent of the total value of shares of a corporation that is the owner of record or has legal title over a foreign financial account. US persons include citizens or residents of the United States and US domestic corporations, including exempt organizations. Normally, the reporting obligation is fulfilled by filing FBARs with the US Department of Treasury on or before 30 June of the succeeding year. Serious penalties can apply if FBARs are not properly filed by 30 June each year, whether the failure to file is inadvertent or wilful. US non-profits have until 30 June 2010 to report foreign financial accounts that are commingled funds (i.e., collective investment vehicles) for those same years.Īll US persons with a financial interest in, or signature or other authority over, any foreign financial accounts, with an aggregate value exceeding $10,000 at any time during the calendar year, must report that relationship each calendar year. In addition, US non-profits must file an FBAR to report financial interests in any foreign financial accounts for tax years 2003-2008 by 15 October 2009 1. The IRS has extended the normal FBAR filing deadline (normally 30 June each year) to 30 June 2010 for US persons with only signature authority over a foreign financial account in tax years 2003-2008. Contact us.US citizen or US resident directors with signature authority over the foreign financial accounts of any non-profit (whether US or foreign) must file Form TD F 90-22.1 (commonly referred to as an ‘FBAR’) each year to report those accounts. We have been helping thousands of Americans residing abroad to file their FBARs, go ahead and take advantage of it. This procedure can also be used to bring you income tax filings up to date.

If you are within the group of US persons that did not get this information before, do not worry, there is an IRS program to help you get up to date with your FBAR filings: the “Streamlined Filing Procedures”. If it is determined that you deliberately avoided filing, the fine can be $100,000 or 50% of the balance of the account at the time of the violation – whichever is greater.

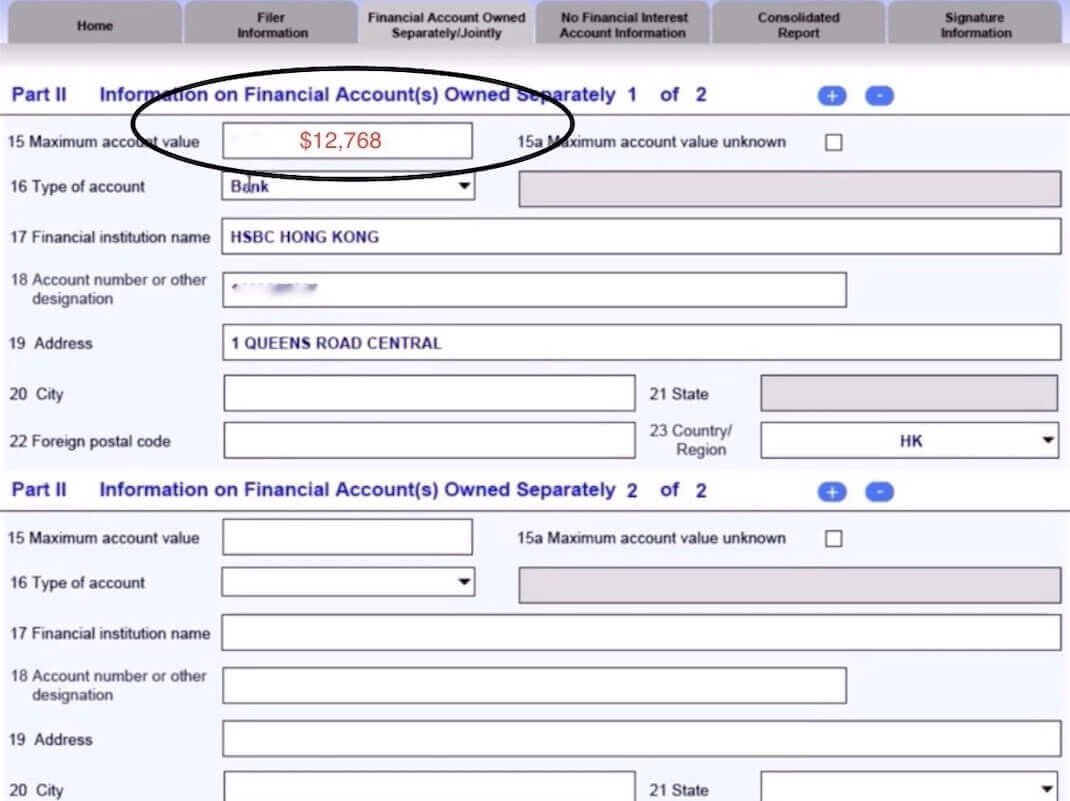

For non-willful failure to file, the fine can be $10,000 per violation. If you fail to file the report or file it incorrectly you may be subject to civil monetary penalties as well as criminal penalties. You can file FinCen Form 114 electronically through the Treasury’s Financial Crimes Enforcement Network website. The form is due on April 15 th in the year following your tax year. You are allowed an automatic extension to October 15 th if you fail to meet the FBAR annual due date you do not need to request an extension. The FBAR, or more formally the “Foreign Bank Account Report,” is an annual report, filed with the Department of the Treasury using the FinCEN Form 114.

So let’s take a moment to explain what an FBAR is in simple terms.Īs a US citizen or resident with a foreign bank or financial account located outside the United States, you may have heard that you have a requirement to file the so-called FBAR.Īs part of the US government’s monitoring of our offshore accounts, a US person must file an annual FBAR to report his or her financial interest in, or signature or other authority over, financial accounts located outside the United States if the aggregate value of those foreign financial accounts exceeded $10,000 at any time during the calendar year. Many Americans overseas may have heard that they could have FBAR filing requirements.

0 kommentar(er)

0 kommentar(er)